Soalan yang biasa tentang harta jual beli bagi pembeli dan penjual. Stamp Duty Case Status.

Background Valuation And Property Management Department Portal

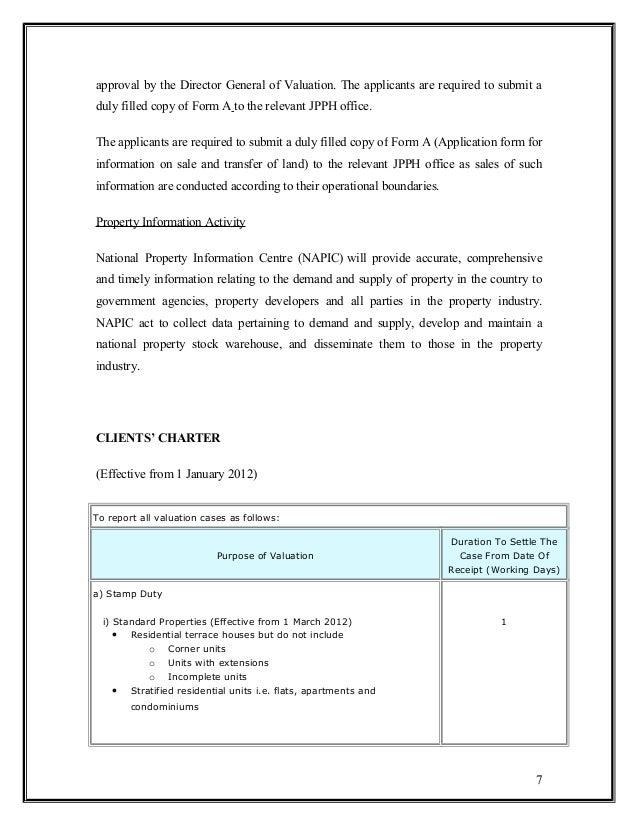

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949.

. 2 caj dikenakan untuk RM100001 sehingga RM500000. Please note that the above formula merely provides estimated stamp duty. Above RM100K to RM500K 2 RM8K.

Setiap peringkat mengandungi peratusan masing-masing. Further to this there is a right of appeal to the High Court. Calculate now and get free quotation.

How can I make an appeal on the stamp duty if I am not happy with the valuation that had been carried out. 1 caj dikenakan untuk RM100000 yang pertama. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949.

Comparables used by JPPH for the low costmedium low cost lot and. As with stamp duty any query on the valuation must be addressed directly to the Estate Duty Office with a copy to JPPH. T 06-285 8888 F 06-232 7729 f GUIDEBOOK on REGISTERING PROPERTY in MALAYSIA NEGERI SEMBILAN Stamp Ofice Inland Revenue Board of Malaysia Seremban Branch Wisma Hasil Lot 461 - 465 Jalan Tuanku Munawir 70000 Seremban Negeri Sembilan.

The adjustment MA. Stamp Duty for Loan. The IRB will impose Stamp Duties based on the valuation reported by JPPH.

Harga Jualan Hartanah Nilai Pasaran yang mana lebih tinggi. Loan Sum x 05. The Estate Duty Enactment 1941 and various other Enactments relating to estate duty were repealed with effect from 1 November 1991.

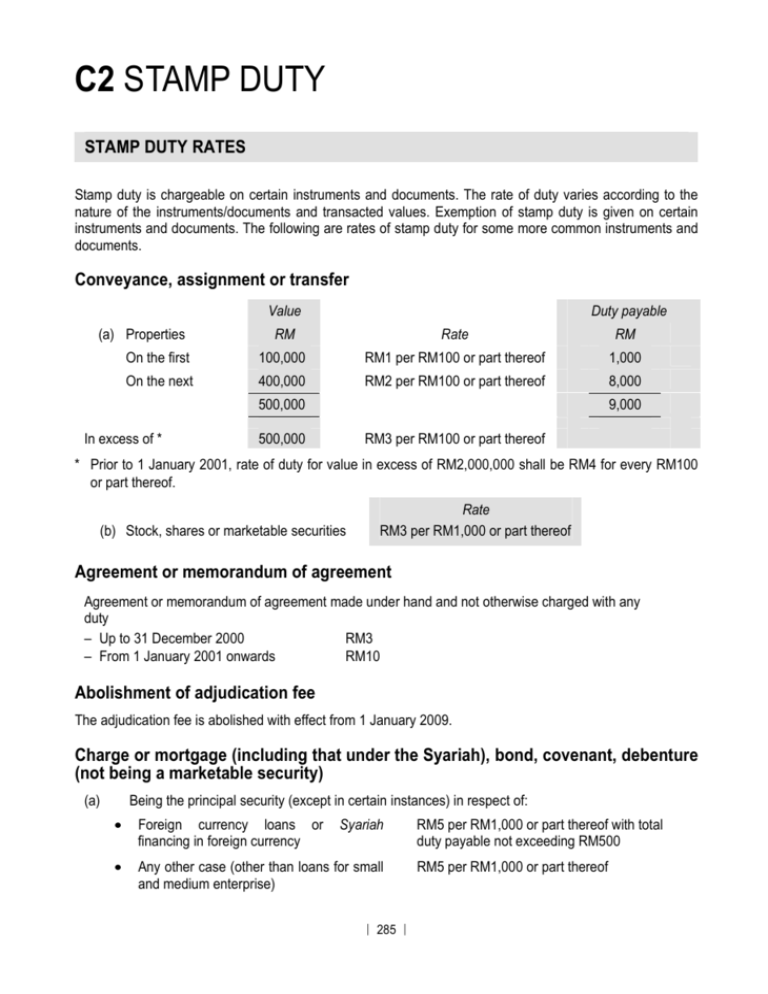

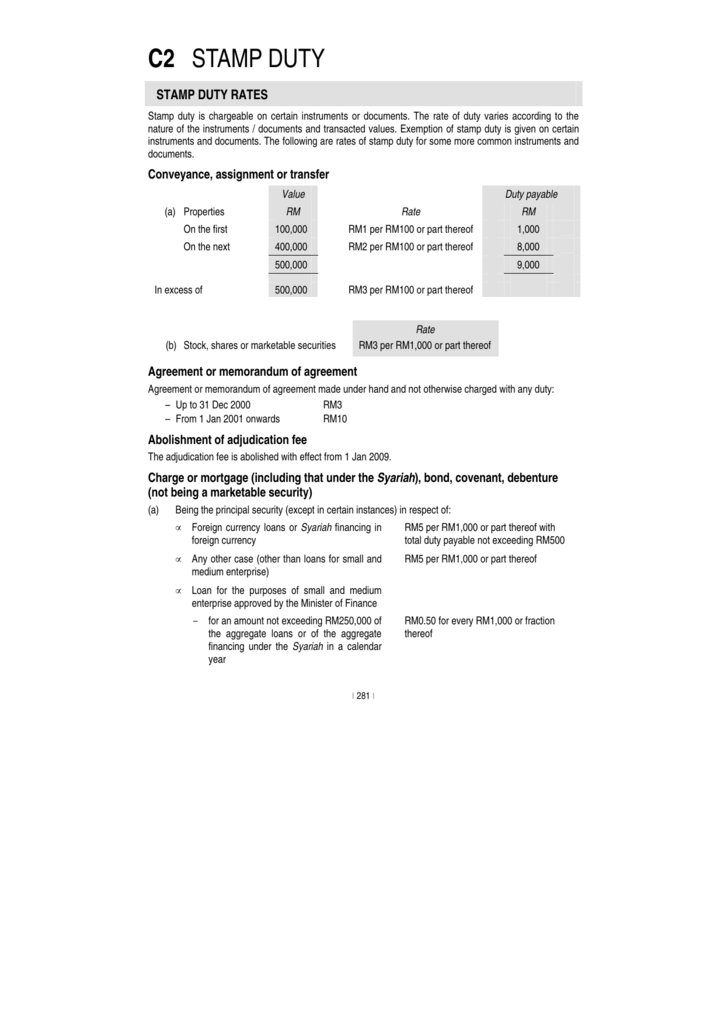

Rumah sewa murah di klang. JPPH Aras 9 Perbendaharaan 2 No 7 Persiaran Perdana Presint 2 62592 Putrajaya Malaysia. C2 STAMP DUTY Stamp duty is chargeable on certain instruments or documents.

Stamp Duty payable is RM1KRM8KRM15KRM20KRM44K. The actual stamp duty will be rounded up according to the Stamp Act. There are two types of stamp duties which are ad valorem duty and fixed duty.

Bilik sewa di shah alam. Stamp Duty Loan Calculation Formula. 2 COURTS DECISION 1.

3 caj dikenakan untuk RM500001 sehingga RM1 juta. JPPH provide consultancy service related to valuation and property services. A valuation report will be prepared by JPPH Malaysia to Inland Revenue Board to imposed the Ad-Valorem Stamp Duty base on the stamp duty rate as stated above.

The rate of duty varies according to the nature. Enquiry on Housing Loan Status. Dato Sr Azmi bin Abdul Latif Ketua Pengarah Penilaian dan Perkhidmatan Harta serta Sr Aina Edayu binti Ahmad Pengarah Pusat Maklumat Harta Tanah Negara NAPIC.

The assessment and collection of stamp duties is governed by the Stamp Act 1949. Pengiraan stamp duty lhdn adalah seperti berikut. When do I need to pay the stamp duty.

Pengubahan Kategori Kegunaan Tanah. Change of Terms Case Status. The transferee is responsible for the payment of stamp duty.

INSPEN was established to enhance the knowledge and through training research and education. Pada kali ini buat julung kalinya NAPIC telah menerbitkan laporan baru iaitu Indeks Sewaan Pusat Beli Belah Lembah Klang untuk rujukan penggiat sektor harta tanah. Unsold Property Enquiry System Malaysia UPESM Mobile Services.

Bilik sewa kl. Estate Duty is imposed on property held by a person. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments.

An instrument is defined as any written document and in general stamp duty is levied on legal commercial and financial instruments. As with the process for Stamp Duty any. Ini tertakluk kepada syarat pemberian diskaun minimum 10 oleh pihak pemaju dan pengecualian atas surat cara pindah milik adalah terhad kepada RM1 juta pertama nilai rumah kediaman.

Above RM1M to RM15M 4 RM20K. Surat cara pindah milik dan perjanjian pinjaman untuk pembelian rumah kediaman berharga antara RM300000 hingga RM25 juta akan mendapat pengecualian duti setem. Feel free to use our calculators below.

Training Research And Education. Stamp duty is the amount of tax levied on your property documents such as the Sales and Purchase Agreements SPA the Memorandum of Transfer MOT and the loan agreement. 4 caj dikenakan untuk semua yang lebih daripada RM1 juta.

Unsold Property Enquiry System Malaysia UPESM Download Forms. The date of the assessment is the date of death. JPPH for comparables used and not the consideration purchase price of the respective comparables are wrong in principle.

What is the basis of the Stamp Duty calculation apart from the schedule rate. Stamp Duty Loan Calculation Formula. House Price Inquiry for Government.

Above RM500K to RM1M 3 RM15K. All appeal on the valuation of property has to be forwarded to the Stamp Duty Office with a. The Enactments however remain.

The stamp duty appeal by KEM Plaintiff was made pursuant to Section 39 of the Stamp Act. The party responsible for this administration assessment and tax is the Estate Duty Collector while JPPH is responsible for assessing the property involved. Please note that the above formula merely provides estimated stamp duty.

Stamp duties are imposed on instruments and not transactions. Stamp Duty Loan Calculation Formula Loan Sum x 05 Note. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

Tiada setem duti dikenakan. NAPIC provide accurate comprehensive and timely information relating to the demand and supply of property in the country. Enquiry on Conversion of Land Use Status.

1st RM100K 1 RM1K. Sebagai contoh RM1200 sewa bulanan dalam masa setahun perjanjian. RM14400 sewa tahunan RM2400 RM250 x RM1 setahun RM48.

The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan agreements dated 1 January 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 July or later. Sewa tahunan RM2400 ke bawah. The stamp duty payable by a purchaser.

After stamp duty is assessed a Notice of Assessment will be issued by IRB to inform the Transfereesolicitor on the amount payable. The actual stamp duty will be rounded up according to the Stamp Act. The Stamp Duty Office SDO of the Inland Revenue Board IRB refers the prescribed form to JPPH where the market value of the property is ascertained and reported within one 1 working day for standard SDO then informs the transferee lawyer of the duty payable.

The Stamp Duty based on the above rate is. If based on the subsequent JPPH valuation the proper stamp duty is higher than the initial duty paid the Collector may within 3 months after payment of the initial duty issue an additional assessment for the. House Price for Goverment.

Enquiry on Stamp Duty Status. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia.

Valuation And Property Management Department Portal Excellent Service Our Commitment

Research Methodology Process Download Scientific Diagram

Jpph Mysms Service Valuation And Property Management Department Portal

Journal Of Valuation And Property Services

Real Estate The Safest Asset Class

Valuation And Property Management Department Portal Excellent Service Our Commitment

Uncategorized Archives Ymg Group

Registering Property In Malaysia Rehda

Stamp Duty Valuation And Property Management Department Portal

C2 Stamp Duty The Malaysian Institute Of Certified Public

Property Registration Procedure In Malaysia Download Scientific Diagram

Real Property Gains Tax Valuation And Property Management Department Portal

C2 Stamp Duty Malaysian Institute Of Accountants

Registering Property In Malaysia Rehda